Fleet Protection & Revenue Program

Inuity Insurance provides a simple, seamless solution to protect your exotic rental fleet while creating a new revenue stream

for your business. Our specialty policies cover the physical damage gap left by a renter’s personal auto insurance, ensuring

that high-value vehicles like Ferraris, Lamborghinis, and McLarens are fully protected. By joining the Inuity network, your

agency can offer renters instant coverage—purchased online in minutes and validated instantly through our secure portal.

In addition to reducing your financial risk, you’ll earn commissions on every policy sold. Partnering with Inuity not only

safeguards your cars but also creates a better customer experience and a stronger bottom line for your business.

Streamlining the Rental Experience

One of the biggest pain points for exotic rental agencies is dealing with insurance variations and inadequate coverage under a

renter’s personal auto policy. These issues can create customer frustration, slow down the check-out process as agencies scramble

to secure new coverage, or even result in lost rental revenue if adequate insurance limits cannot be verified. Inuity eliminates

this friction by providing a straightforward, excess physical damage policy designed specifically for exotic cars. Policies are

purchased online in minutes and validated instantly, allowing agencies to keep cars moving, customers happy, and revenue flowing.

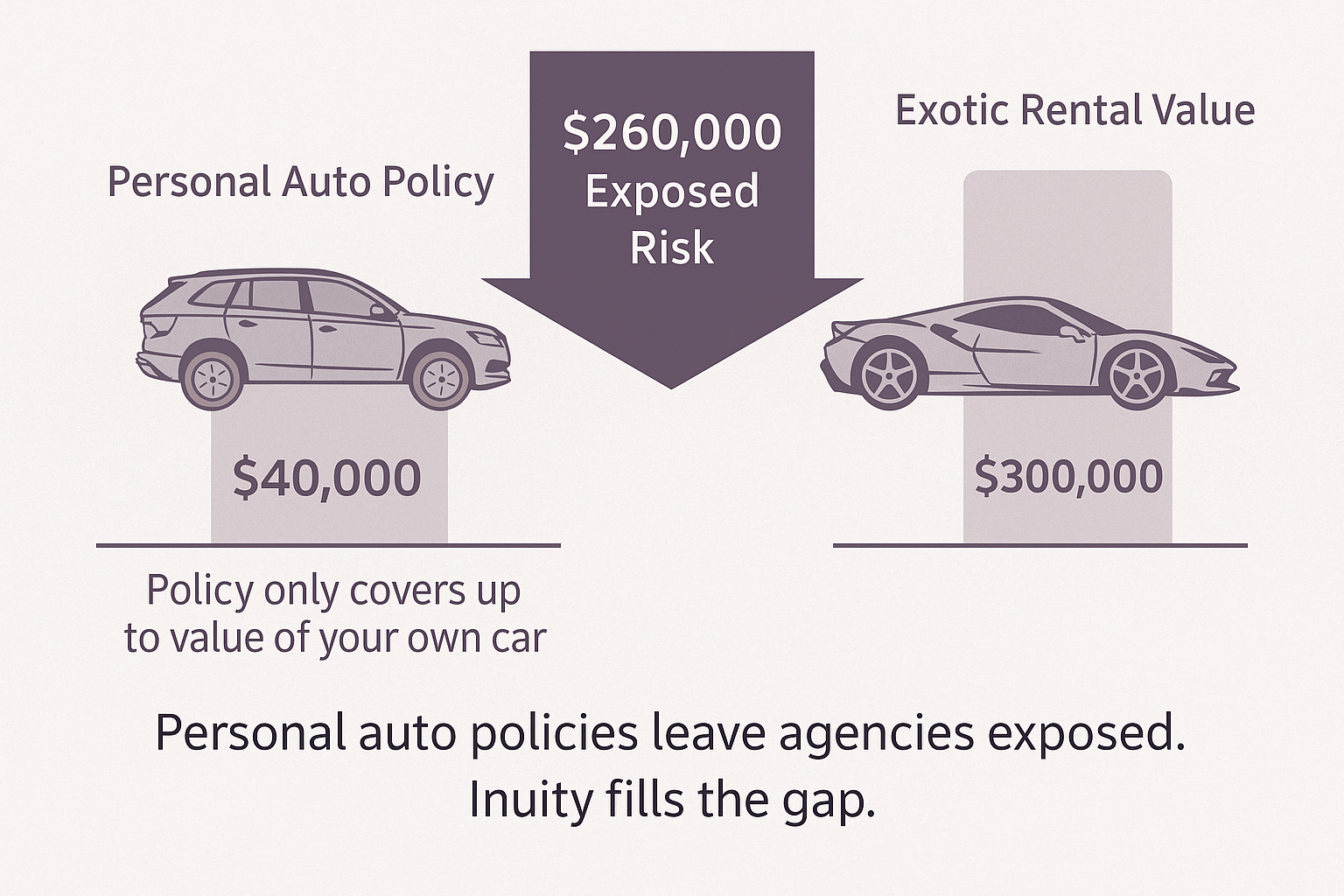

Verification Calls ≠ Full Coverage

Even if an insurer confirms that a renter’s personal policy “extends to rentals,” coverage is capped at the value of

the renter’s own car—not the exotic in your fleet.

No Cost to Join

Becoming an Inuity rental agency partner is free—there are no fees or hidden costs. Start offering coverage, protecting

your fleet, and earning commissions right away.

Why Personal Auto Insurance Isn’t Enough

Many exotic rental agencies assume that a customer’s personal auto insurance will automatically cover the full value of a Ferrari,

Lamborghini, or McLaren. Unfortunately, that assumption is both common and incorrect. Standard auto policies extend

coverage to rentals only up to the value of the insured’s own car—not the vehicle they are renting. So if a customer drives a

$40,000 SUV at home, their insurance will cap coverage at $40,000, even if they are renting a $300,000 exotic. Exotic rental agencies

often call the customer’s insurer to “verify coverage,” but those confirmations can be misleading because the policy still

contains hidden limits and exclusions. In the event of a major accident or total loss, the agency—not the insurer—will be left

exposed to the uncovered difference. Inuity solves this problem by providing specialty excess coverage designed specifically for

exotic rentals, giving agencies real protection and peace of mind.

Benefits of Joining

- Protect Your Fleet – Ensure your high-value vehicles are fully covered where standard insurance falls short.

- Earn Commissions – Agencies can earn $50 to $100 per policy sold, creating a new revenue stream.

- Instant Verification – Policies are purchased online by renters and validated instantly in our secure portal.

- Enhance Customer Confidence – Give renters peace of mind knowing they’re properly insured.

- Streamlined Operations – Easy-to-use tools and responsive support keep your team focused on clients.

- Backed by Experience – Supported by Inuity’s dedicated staff in Phoenix and the resources of Pivot Equity.

- Stay Competitive – Stand out from competitors by offering coverage that protects both your business and your customers.